Learn specific technical abilities, strategic competencies, and practical upskilling steps to transform from data processor to strategic advisor in the age of AI-powered accounting. While the concept hasn’t changed, the implementation of subledgers in today’s enterprise systems is far more sophisticated than in traditional accounting. As your business scales, the growing volume of transactions can become difficult to record and manage by hand. If you’d like, you can create a subledger for every type of account your business manages. Make sure to regularly review your subledger accounts and reconcile them against the general ledger.

The benefits of using subledgers

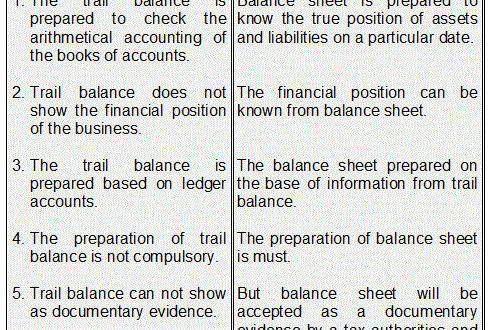

Taxes, pensions, and bonuses will also be recorded in this section. His general ledger states that his business owes £5,000 to his suppliers and that his customers currently owe him £3,500. However, when looking at this data in the general ledger, Joel has no idea who the suppliers are that he owes money to or what customers in particular are behind in their payments. The accounts of the general ledger form part of the trial balance. The entries for the general ledger are lower, seeing as they are the balances and total of the subsidiary ledger. Discover how accountants can develop essential AI skills for 2025 and beyond.

- While not explicitly describing subledgers, the system described Pacioli laid the groundwork by establishing the importance of organized, systematic record-keeping.

- Layer 1 fees can spike to $20-$40 per transaction during busy periods.

- By looking at the sub-ledger, we will be able to know which customers owe us, how much, and how long it has been.

By following best practices and choosing the right software, organizations can maximize the benefits of subledgers and gain a competitive edge in the market. A general ledger contains summary-level financial data that appears in financial statements, while a subledger provides detailed transaction information that supports general ledger entries. The general ledger shows account balances, while subledgers track individual transactions that make up those balances. In the realm of accounting, a subledger is a type of ledger that is used to record and classify specific types of transactions or accounts within a general ledger.

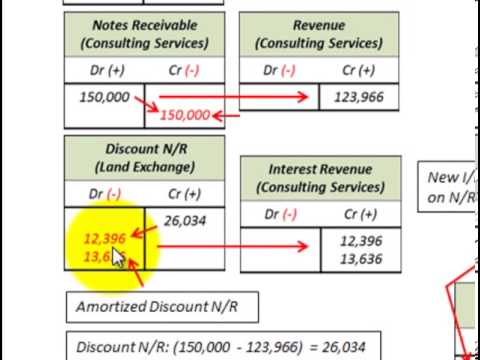

The general ledger can provide a great overview of where each of your accounts stands at the end of the period. Subledger intends to give the specifics what is a subledger that make up a particular account, whereas general ledger (GL) intends to give each account’s balance in the accounts chart. After recording all these transactions, the company has a closing balance of $12,000 as of December 31, 2018, which they will receive from its debtors in the coming year. When unsure, check if the project depends on another chain—that usually means L2 or L3. Over time, you will get used to spotting these different layers. It’s nested blockchains, interlinked protocols, and flexible stacks.

A growing business will require more involved accounting procedures. Maintaining subledgers within your general ledger ensures that your accountant or bookkeeper can easily monitor and update transactions as they occur to better manage cash flow. Subledgers segment transactions into easily accessible sections that can then be analysed to provide a detailed overview into the financial history of a business.

Typically, it’s a good idea to do so at the end of each period, before financial statements are finalized. Even small businesses can have hundreds of transactions occur each period. Any transactions that impact inventory will be listed in this subledger, helping you assess the value of goods you have available for sale at a given moment. In an inventory ledger, you can track crucial information like the amount of finished goods, works in progress, and raw materials you have. To get more specific details for a given account, you’ll need to step beyond the general ledger and reference the subledger.

Knowing the difference between subledger and general ledger for better transactions

Subledgers are specialized accounting records focusing on specific financial categories. They make managing detailed financial data easier by organizing it in a clear way. Categories like accounts receivable, accounts payable, or fixed assets have their own subledgers, which gather transaction details such as dates, descriptions, and amounts. Categorization isn’t limited to different accounting processes. The totals from each Subledger are periodically summarized and posted to the General Ledger.

Journal Entry

The credit purchase will increase the payable balance and cash payment will decrease the balance. However, we cannot know the balance that we owe to each supplier as it shows only the total amount. HighRadius leverages advanced AI to detect financial anomalies with over 95% accuracy across $10.3T in annual transactions.

Management

For example, accounts receivable is the general ledger that records all transactions related to the sale on credit and cash collected from the customer. At the end of the month, we can see the trail balance of accounts receivable with the amount that customers owe to us. However, we do not know the detailed balance of each customer.

As a business grows, there are often individuals or entire departments dedicated to the oversight, maintenance, and analysis of subledgers like accounts receivable. Important subledgers can often become their own ecosystem, forming an important foundation to a business’s general ledger as well as larger financial reports. Most accounting software programs will automatically manage your subledger totals based on the transactions recorded in the platform. Similarly, an accounts receivable ledger tracks transactions related to sales made on credit, including all payment history and any outstanding balances. Subledgers can also be helpful in auditing or reviewing financial statements, as they provide a more detailed view of where money is being spent. Overall, subledgers are a valuable tool for managing finances and ensuring that businesses have a clear understanding of their financial position.

- These steps are used to avoid cluttering the general ledger and to produce your company’s financial statements.

- A bank account subledger is a record of all the transactions that have taken place in a particular account, providing a detailed history of the account.

- Subledgers are an important bookkeeping tool to keep financial records organized.

- It tracks the details of specific types of transactions and records what happens in specific categories within a business’s chart of accounts.

- For example, Ethereum remains secure at its base, while Layer 2 rollups process multiple transactions off-chain to ease congestion and reduce fees.

If you do catch a discrepancy between a subledger and your general ledger, you need to make the appropriate adjusting journal entries to close out your accounts for the period. In turn, subledgers can offer valuable insights into the business’s financial activities, helping to drive budgeting and financial planning decisions. It’s useful to create a subledger to organize the transactions for accounts with a lot of activity, especially those where cash inflows and outflows are coming from multiple sources. Company makes most of the money from sales while spending most of them on purchasing inventory, payroll, rental, and other operating expenses.

So far, we’ve covered the internal structure of a blockchain. But when people say “Layer 0,” “Layer 1,” and so on—they’re talking about how blockchain networks stack on top of each other. Here’s what each layer does, why it matters, and where real-world projects fit in. Nodes talk to each other here, sharing data and blocks in a decentralized way. When a new transaction is created, it spreads through the network like a signal in a nervous system. This layered setup helps developers improve parts of the system without changing everything at once.

One layer handles data flow, another secures the network, and yet another scales performance. For example, Ethereum remains secure at its base, while Layer 2 rollups process multiple transactions off-chain to ease congestion and reduce fees. The totals in subledgers are regularly reconciled and posted to the general ledger, ensuring consistency and accuracy in the accounting system. A general ledger is an account that collects and assembles the balances of every related subsidiary ledger accounts. It is comparable to a leading account as it is the principal set of accounts.

To help you reconcile vendor accounts and get a more detailed breakdown of the individual transactions and payables owed to each supplier, an accounts payable ledger can be a helpful resource. The subsidiary ledger comes first since the balances of a general ledger are posted after entries are made in the subledger accounts. The four sections in a general ledger are financial transactions, accounting periods, a chart of accounts, and account balances.

They process sidechain transactions using their own consensus mechanisms and validators, separate from the main chain. A Layer 2 chain, in contrast, lets users fall back on Layer 1 for dispute resolution and finality. Many blockchains, like the Bitcoin blockchain, operate just fine without Layer 0 or 2. Every chain has internal layers (hardware, consensus, etc.)—those are part of any blockchain technology. Instead, they complement each other to form a complete blockchain.

With 7 AI patents, 20+ use cases, FreedaGPT, and LiveCube, it simplifies complex analysis through intuitive prompts. We understand that it must be tiring to manually maintain a voluminous general ledger. An automated accounting system eliminates the need to manually enter data into the accounting books.